Growing up, my parents had strong opinions around money and equality. They told me:

- money was unimportant, boring and evil

- people who work with money are greedy and not talented

- For me to become equal, I had to wait for the government or my employer to make me equal – my equality was dependent upon somebody else. I was helpless.

My parents were wonderful people although a little misguided and on these three points they were dead wrong. With 30 years of experience as a finance executive and professor, my message to women is that money is important and if you seek FINANCIAL ENGAGEMENT by committing to learn how money works you can choose to be equal! You are not helpless.

My story of overcoming helplessness through financial engagement is just one of many – but worth sharing.

Picture this, I am 17 years old. My father finally landed a job after 2 years of unemployment requiring the family to move 500 miles away, leaving me behind. They thought it would be best for me to stay in NJ where I qualify for in-state tuition. They want me to go to college but they have no money to send me there. All my childhood, my family struggled with money. Is it a surprise with a mindset that says money is evil? My parents had both grown up in the projects in New York City and although they were smart, educated people, they were not educated about money. Their lack of ownership over money led to many bad situations including leaving me on my own at 17 to figure out what to do with myself. I get a job at a local restaurant, working as a waitress but after I pay tuition there isn’t a lot of money left over. I am struggling. I tell my roommates I need to move out. I don’t tell them I can’t pay rent – I’m too embarrassed; I just leave knowing they could easily find someone else to pay rent. I organize my clothes in the trunk of my car and strategically plan visits with friends hoping they will invite me to sleep on their couch for the night. I am grateful when they invite me for dinner but if not, I simply don’t eat. I continue to have difficulties with money up until the time I graduate…and get married. Yes, I was too young to get married but at the time it seemed like a good idea since I liked him a lot and although this is hard to admit to all of you – really I have trouble admitting this to myself – marriage was a way to achieve financial security. There I said it. I felt dependent and I felt helpless.

Today if you listen to the news it seems many women feel helpless. A person who feels helpless feels ineffective, incapable, like their voice doesn’t matter. So I ask, raise your hand if you never felt ineffective at something. Not too many people can say that, right. It’s part of being human. Yet as a woman sometimes I feel like I am expected to be helpless. Old lingering stereo-type messages pop up in the darnedest places, telling me – let him drive…he should take over the finances…maybe you should let someone else make that decision. These thoughts have left me in the passenger seat – in my own life. Feeling helpless.

But what I finally learned over time is the only way I could stop feeling helpless was to take ownership for my needs and wants. I needed to be crystal clear in my own mind of what I wanted so nobody else could make choices for me. Once I learned that, my entire life changed.

My story could motivate others to change their lives too. Maybe just one single young woman.. maybe it is you who will listen me. My plan is to convince you how important it is to become FINANCIALLY ENGAGED. Okay, I know what you are thinking. Money is unimportant, boring and evil – who cares? Really, not you too? Well you should care, we all should because if you become financially engaged you will be far from helpless. You will have the confidence to;

- Protect yourself from FUTURE FINANCIAL DISTRESS and even DISASTER, and also

- Live your life on your own terms, consistent with your OWN DREAMS, and also

- Make smart decisions that influence your FAMILY, WORKPLACE AND COMMUNITY, and also

- Participate as an equal, contributing as a valuable team player in the big decisions that shape our WORLD. Finding meaning, purpose, joy and well-being in her life. Simply because you are financially engaged. 100 percent!

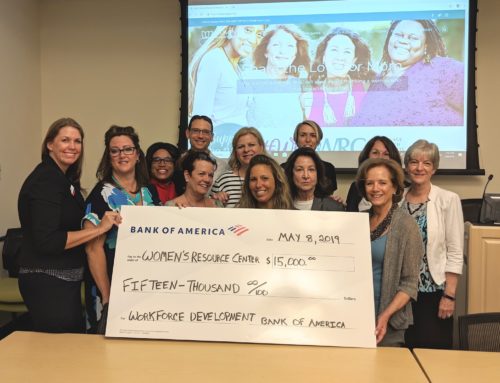

That’s my big idea. That’s the reason I volunteered to start the Women’s Money Empowerment initiative at the Women’s Resource Center. Just that.

Am I assuming all women are helpless or even not financially engaged?

Of course not, but some women have overlooked (or perhaps ignored because they think it is unimportant, boring and evil) the relevance of financial engagement. Understanding how money works allows us to become equal contributors in the world. Two unlikely coconspirators, money and equality – or maybe not so unlikely.

We all know, gender equality has been a topic of discussion for over a hundred years, with 4 waves of the women’s movement, focused on consciousness-raising issues such as; women’s voting rights, workplace discrimination and sexual harassment but without a final practical solution.

After 4 waves it seems like gender equality may still have an UNCERTAIN FUTURE;

- Many women still feel vulnerable and frustrated in general – Have you watched the news lately?

- Many women don’t feel they are adequately compensated or rewarded in the workplace

- Many women don’t feel like they are included in big decisions they face in their lives

- Many women feel at best like they are not heard, considered or included and at worse like they are helpless.

Consider this. Equality, True equality is about having choice and influence and the ability to create meaning, purpose, joy and well being in our lives. Instead of focusing on the helplessness of inequality, I propose a 5th wave focusing on a solution – where women chose ownership in an area where women historically haven’t participated and still don’t (according to the data). It involves money.

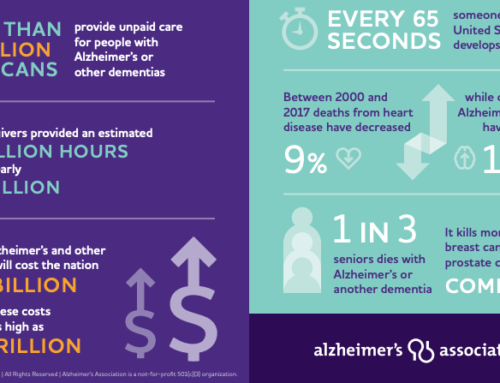

Why money? Social scientists tell us whoever controls the most important resource has the power. Undeniably in modern society, money is our key resource. Think about it, control over money offers choice and creates the ability to influence what means most to us. Notice we are not talking about dying with a big pile of money – we are talking about using money as a tool to make our lives and our world a better place.

Nearly all important decisions at home, at work, in the community and in the world have financial consequences. With financial understanding we can contribute to all these important decisions as equals.

It is encouraging when we see women motivated to take ownership of their financial decisions;

- Janet, a woman I recently helped, diligently paid off her student loans and her credit cards one by one with patience and persistence and is now completely debt free. She took ownership of her financial freedom and her her ability to care for herself and her family.

- Another woman I worked with years ago, Pat collaborated with her husband to select a survivorship payout option for their annuity. Now years later her husband has passed away but her preparation left her with adequate income. She took ownership over her retirement and her future.

- There are women throughout the country who have joined forces by creating giving circles where they choose a charity they want to support. It is important to recognize these women don’t necessarily have a lot of money themselves but they have the ability to direct money where it is most needed. They are taking ownership and are making a difference in our communities and the nation.

But as a financial professional advocating for women, I receive hundreds of phone calls from too many women all over the country who are in trouble. It’s heart breaking since many of their problems could have been prevented.

There are others around the country who also help women piece their lives together – but we are a small army, we can’t reach all the women who need help. Furthermore, I’m tired of helping women after they have a problem and their lives are in shambles. I don’t want to tell another 65- year-old woman that she can’t stop working or a newly divorced mother she has to sell her house that her children were raised in or a young family they can’t go to Disney World because their debt is out of control. I want to inspire women before they have a problem and even change the trajectory of their lives so they actually have choices and influence.

This is why we need a revolution. This is why we need the 5th wave of the women’s movement. Financial engagement is not just about money. It is bigger than money. It is about equality.

The Women’s Money Empowerment Program Women, a Women’s Resource Center Initiative is a program created for you to take ownership. Proactively seek FINANCIAL ENGAGEMENT by committing to learn and understand how money works so you can choose your life and contribute to your family, community and the world as an equal. You will have a voice!

So let me let me tell you the rest of my story. It is now the winter of 1986 and I have now been married for four years. My first husband (the one I married for financial security) has lost his job and we have no money. Ironic, right? It’s not like I never “had no money” before. Those times as a teenager were difficult, but this time as my husband is telling me there is no money, this time is different. This time I have someone counting on me. I have a child. I am not about to allow the cycle to continue. My child will never experience the hardships that I endured. Never. My maternal instinct goes into super drive. It is on this day that I decide to enroll in a finance class at a local university – my alma mater, 10 minutes down the road. I also make a promise to myself to take ownership for the financial choices in my life. It is on this pivotal day, when I am no longer helpless. And I am humbled and grateful to tell you that since that day, 30 years later, I own my choices, I have influence and I am equal. It was work but it is well worth it.

The women’s movement is said to have occurred in 4 waves. Let’s make the 5th wave, the last wave. Let’s make the 5th wave about promoting financial engagement for all.

Imagine a world where women participate along with the men in all major decisions – with financial knowledge, new ideas and new ways of thinking. That’s equality. That’s the 5th wave.

Contributed by,

Laura Mattia, Ph.D., MBA, CFP®

Leave A Comment